On december 31 2024 when its allowance for doubtful accounts – As of December 31, 2024, the allowance for doubtful accounts takes center stage, inviting us to delve into its intricacies. This discussion will explore the purpose, calculation, and impact of this crucial accounting concept, providing valuable insights into its role in financial reporting and internal controls.

The allowance for doubtful accounts plays a pivotal role in ensuring the accuracy and reliability of financial statements. By estimating the potential uncollectibility of accounts receivable, businesses can mitigate the risk of overstating assets and understating expenses, thereby enhancing the credibility of their financial reporting.

Allowance for Doubtful Accounts: On December 31 2024 When Its Allowance For Doubtful Accounts

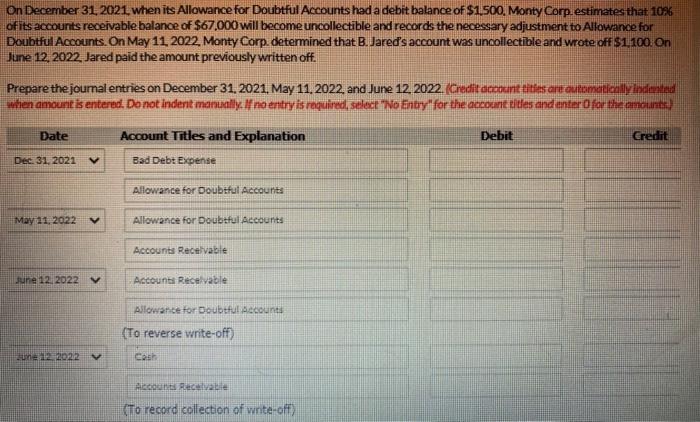

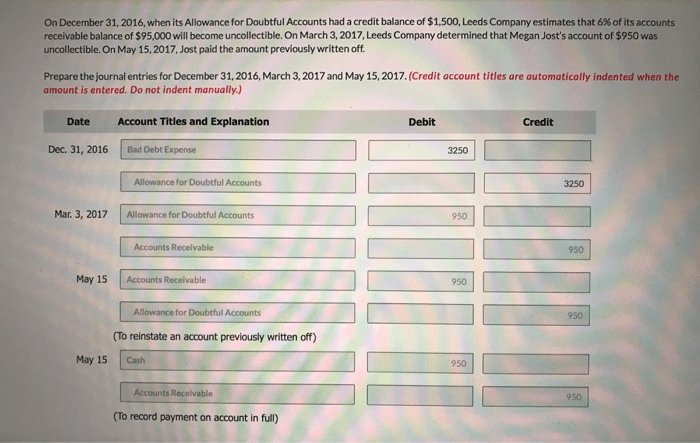

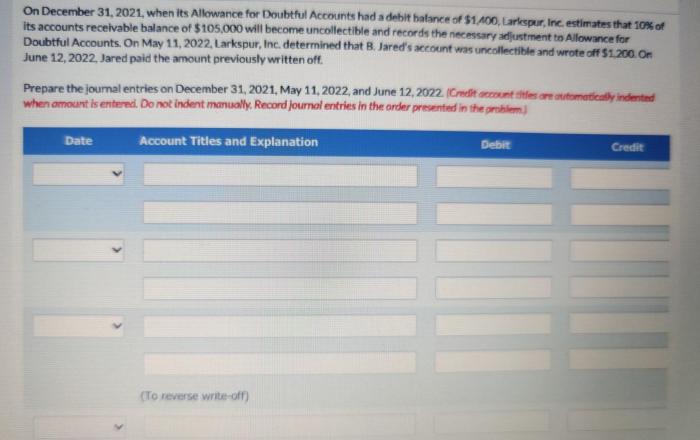

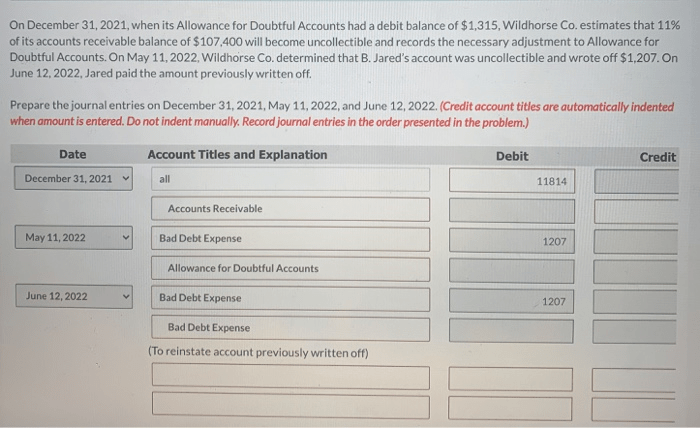

The allowance for doubtful accounts (ADDA) is an accounting provision that estimates the amount of uncollectible accounts receivable. It is calculated as a percentage of the net accounts receivable balance and is recorded as a contra-asset account. The purpose of the ADDA is to reduce the carrying value of accounts receivable to its estimated realizable value.

The factors considered when estimating the ADDA include:

- Historical bad debt experience

- Current economic conditions

- Customer creditworthiness

- Industry trends

The ADDA is used in accounting to:

- Reduce the carrying value of accounts receivable to its estimated realizable value

- Match bad debt expense with revenue

- Provide a buffer against unexpected bad debts

Bad Debt Expense

Bad debt expense is the expense recognized when an account receivable is deemed uncollectible. It is calculated as a percentage of the net accounts receivable balance and is recorded as an expense on the income statement.

The different methods used to estimate bad debt expense include:

- Percentage of sales method

- Aging of accounts receivable method

- Historical bad debt experience method

Bad debt expense is used in financial reporting to:

- Match bad debt expense with revenue

- Provide a buffer against unexpected bad debts

- Impact the net income and retained earnings

Impact of ADDA on Financial Statements

The ADDA has a significant impact on the financial statements. It reduces the carrying value of accounts receivable on the balance sheet, which in turn reduces the net income on the income statement. The ADDA also creates a buffer against unexpected bad debts, which can improve the financial stability of a company.

Underestimating the ADDA can lead to an overstatement of net income and assets, while overestimating the ADDA can lead to an understatement of net income and assets. Both of these can have a negative impact on the financial ratios and other key performance indicators of a company.

Internal Control over ADDA

Internal controls are essential to ensure the accuracy of the ADDA. These controls include:

- Proper credit approval procedures

- Regular monitoring of accounts receivable

- Establishment of a bad debt reserve

- Periodic review of the ADDA by management

The auditor plays a key role in assessing the adequacy of internal controls over the ADDA. The auditor will review the company’s credit approval procedures, monitoring of accounts receivable, and bad debt reserve. The auditor will also test the accuracy of the ADDA by comparing it to historical bad debt experience and industry trends.

FAQ Resource

What is the purpose of the allowance for doubtful accounts?

The allowance for doubtful accounts is an accounting estimate that represents the portion of accounts receivable that a business expects to be uncollectible.

How is the allowance for doubtful accounts calculated?

The allowance for doubtful accounts can be calculated using various methods, such as the percentage of sales method, the aging of accounts receivable method, or the historical experience method.

What are the consequences of underestimating or overestimating the allowance for doubtful accounts?

Underestimating the allowance for doubtful accounts can lead to an overstatement of assets and an understatement of expenses, while overestimating the allowance can result in an understatement of assets and an overstatement of expenses.